Your Guide to Down Payment Assistance

|

||||||

|

|

|

||||||

|

|

As you may know, saving for a competitive down payment was one of the primary obstacles homebuyers faced in 2023.

With high prices and rising mortgage rates, many buyers have turned to down payment assistance (DPA) for relief. But while DPA can reduce upfront costs and make homeownership more accessible, it’s not necessarily for everyone.

Let’s weigh the pros and cons of DPA so you can make an informed decision.

Types of Down Payment Assistance

DPA comes in a variety of forms, including:

Pros of DPA

DPA programs can reduce the financial burden of the down payment, allowing you to start the home search and purchase process earlier. DPA also reduces lender risk, making financing (and lower rates) more accessible. Plus, many DPA programs require no repayment whatsoever.

Cons of DPA

There are eligibility requirements. Most DPA programs are geared towards first-time buyers and low- to middle-income borrowers who are purchasing a primary residence. Additionally, payback requirements mean that if you don’t stay in the home for a designated number of years, you may be required to pay back the assistance in full. And, finally, DPA can delay the closing process, putting you at a disadvantage in a competitive market.

If you have questions about home financing, reach out today for expert assistance.

Traditionally, wintertime is a downtime for the real estate market. The weather is colder, wetter and often messy, which can be a little off-putting for potential homebuyers and sellers.

But despite these seasonal challenges, winter can actually be advantageous for anyone interested in buying or selling a home.

In fact, winter can offer buyers and sellers many benefits that other seasons cannot.

For Buyers

For Sellers

For Buyers and Sellers

Any questions? Reach out today for more expert advice.

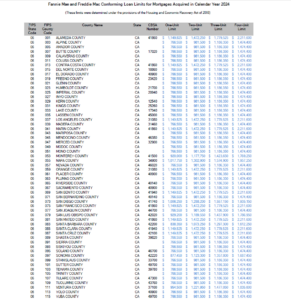

https://www.americaonemortgage.com/wp-content/uploads/2024/01/CA-Loan-Limits-2024-v2.pdf

Unlocking the Value of Your Home: The Power of a Home Equity Line of Credit

Introduction: Picture this: John and Sarah, a young couple in their mid-30s, recently realized that their home could be more than just a place to live—it could be a key to financial flexibility. Like many homeowners today, they were exploring ways to optimize their finances without disrupting their low mortgage rates. This is where their journey with a Home Equity Line of Credit (HELOC) began, and it could be the start of yours too.

What is a HELOC? A Home Equity Line of Credit, or HELOC, is a financial tool that allows homeowners to borrow against the equity in their homes. It’s a flexible option for accessing funds without the need to refinance your existing low-interest mortgage.

Why Consider a HELOC?

Standalone HELOC: This is perfect for homeowners like John and Sarah, who wanted to tap into their home’s equity without affecting their favorable mortgage terms. It’s independent of who originated your mortgage and offers a straightforward way to access cash.

Piggyback HELOC: Ideal for new borrowers, this option allows you to secure a mortgage and open a HELOC simultaneously. It’s particularly useful for those needing extra funds for down payments or looking to qualify for a conforming loan.

Client Story: Take the case of Emily, a single mother who used a HELOC to fund her daughter’s college education. “The flexibility and ease of access to funds were a game-changer for me,” she shared. Emily’s story is just one of many where a HELOC has provided financial breathing room.

Key Benefits of Our HELOC:

Understanding the Terms: Let’s break down some key terms:

Your Path to Financial Flexibility: A HELOC with America One Mortgage Corporation is not just about accessing funds; it’s about empowering your financial future. Whether it’s for debt consolidation, home renovations, or educational expenses, we’re here to help you unlock the potential of your home equity.

Get Started Today: Ready to explore how a HELOC can benefit you? Contact us to start your journey towards financial flexibility. And remember, just like John, Sarah, and Emily, your home might just be the key to achieving your financial goals.

Homeownership is more than just a place to reside; it’s a valuable asset that can provide financial solutions when you need them most. With a HELOC from America One Mortgage Corporation, you’re not just borrowing money but investing in your future.

Call America One Mortgage Corporation

1-888-942-5626 or reach out to us at www.LoanRhino.Com

When you purchased your home, it felt like a dream come true. Now, it feels like you’re waking up to a not-so-rosy reality. Why is that so?

You may be outgrowing your home. As a household’s size, preferences and priorities change over time, a once ideal living space can start to feel unlivable. Upgrades and renovations can alleviate these growing pains, but sometimes relocation is the best solution.

4 Signs You’ve Outgrown Your Home

1. Renovations have become constant or unrealistic.

Every home needs a little work from time to time, but renovations shouldn’t be an ongoing necessity. Plus, property limitations like your home’s size or HOA regulations can make certain renovations impossible. Once the constraints of your existing property prohibit necessary upgrades, it might be time to consider looking elsewhere.

2. You’re running out of space.

As new children, relatives and pets enter the household, it might start to feel cramped. Even a single-person household can start to feel too small as belongings accumulate over time.

3. Your lifestyle no longer suits the location.

Initially, your downtown apartment made perfect sense. It was within walking distance of your office, not to mention local pubs and eateries. But now you’re a parent working from home with a kid who will be starting school next fall. Suddenly, an affordable suburban home not far from school might sound more appealing.

4. Your income has changed.

Maybe you’ve received a promotion at work that’s significantly increased your salary and cash flow. Or maybe you’ve decided to quit your job, empty your savings and start your own business. Either way, now’s the perfect time to reconsider the suitability of your current living situation and adjust accordingly.

Thinking of making some changes? Reach out to discuss your home financing opportunities.

In 2022, the prime rate went up by 4 points, going from 3.5% to 7.5%. This happened because the Federal Reserve wanted to better manage inflation. By July 2023, the prime rate had gone up to 8.5%

But what does all of this actually mean? What is the prime rate, and how does it impact financial products like credit cards and loans? Why does it fluctuate and how?

What is the prime rate?

The prime rate refers to the best possible interest rate a lender can offer to a borrower. Only the most creditworthy of borrowers with the lowest risk of default are eligible. As a result, the prime rate is typically reserved for corporations.

Individual financial institutions determine the prime rate, not the federal government. However, the prime rate is heavily influenced by the federal funds rate set by the Federal Open Market Committee (FOMC). In most cases, the prime rate equates to the current federal funds rate plus 3%.

How does the prime rate impact financial products?

Lenders use the prime rate as a benchmark for determining consumer interest rates on financial products like loans and credit cards. For example, a low-risk borrower might receive the prime rate plus 9% (compared to 15% for high-risk borrowers).

When the prime rate fluctuates, so do the interest rates consumers receive. Prime rate fluctuations also impact variable-rate products like credit cards, adjustable mortgages and home equity loans.

What makes the prime rate go up and down?

The prime rate isn’t fixed, has no limits and can fluctuate over time. Fluctuations tend to coincide with changes in the federal funds rate, the benchmark most commonly used to determine prime rates. But the prime rate can also be impacted by inflation and loan demand.

Want to learn more about your loan options? Get in touch.

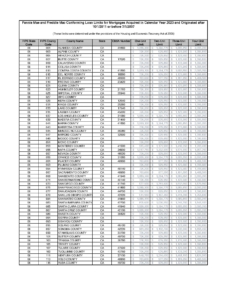

https://www.americaonemortgage.com/wp-content/uploads/2023/09/2023-Conforming-Limits.pdf

Homeownership is a significant milestone in many people’s lives. It’s not just about finding the perfect house; it’s also about ensuring that your finances are in order to support this long-term commitment.

This newsletter will help guide you through some essential steps to prepare your finances for homeownership:

1. Assess Your Financial Situation: Calculate your monthly income, expenses, and existing debt. Understanding your limits and capabilities will help you determine a realistic budget for your future home.

2. Establish a Budget: Create a budget that includes all housing-related expenses, such as mortgage payments, property taxes, insurance, and maintenance costs. Remember to leave room for unexpected expenses to avoid any financial strain in the future.

3. Save for a Down Payment: A general rule of thumb is to aim for 20% of the total cost, but it’s important to note that you can often have a much lower down payment if you’re willing to pay for private mortgage insurance (PMI). Consider setting up a separate savings account dedicated to your homeownership goal.

4. Improve Your Credit Score: Review your credit report, identify any errors and take steps to improve your score. Pay your bills on time, reduce your debt-to-income ratio and avoid taking on new debt in the months leading up to your mortgage application if you can.

5. Get Pre-Approved for a Mortgage: Before you start house hunting, get pre-approved for a mortgage. This process will help you understand how much you can afford and can help make your offer more attractive to sellers.

6. Plan for Closing Costs: In addition to the down payment, you’ll need to plan for closing costs, which typically range from 2% to 5% of the home’s purchase price. Include these costs in your budget and save accordingly.

7. Consult with Professionals: Seek guidance from professionals, such as mortgage experts, real estate agents and financial advisors, who can provide valuable insights and help you navigate the process.

If you have any questions or would like to learn more about your financing options, get in touch.

More than 43 million Americans have student loans. So if you’re hoping to buy a home with student loans in tow, you’re not alone.

Fortunately, student loans are treated just like any other debt when applying for a mortgage. While having lots of debt can certainly make the process more challenging, it doesn’t disqualify you by any means.

Are you hoping to buy a home while still paying off student loans? Here’s what you need to know.

Want to know how your student loans will impact your mortgage options? Reach out today to get your questions answered.

We take pride in providing you with excellent service and appreciate the opportunity to assist you with all your mortgage needs.